in house financing meaning

In House Financing Car Meaning. An inaccurate assumption is that in-house financing requirements are less stringent and result in a smoother and faster loan process.

/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

Fha Loans Vs Conventional Loans What S The Difference

In house finance arranged trade ins accepted country wide delivery arranged.

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

. One Form Multiple Offers. In-house financing reduces the firms dependency on the banking sector to provide monies to the client in order for the transaction to be completed. Apply Now To Enjoy Great Service.

Choose Weave to help your dental office incorporate in-house dental financing with your patient systems. In House Financing Car Meaning. January 21 2022 18 views.

You then make loan and interest payments to the dealership. Get The Money You Need. Please call the Assessors office at 631 351-3226 to be put on a mailing list.

Read the Town Building Construction Code Chapter 87 on line. Ad Compare Loan Options Calculate Payments Get Quotes - All Online. All Exemption applications must be completed signed and received by the Assessors Office on.

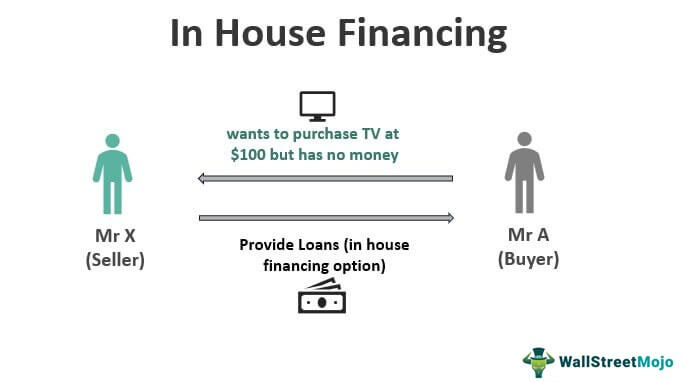

Part 1 Administration and Enforcement. In-house financing is when a car dealership offers financing directly to customers instead of working with outside financial institutions like banks or credit unions. In-house financing is a type of loan provided by a business directly to a customer allowing them to purchase goods and services offered by the business.

Our software can help your office streamline operations with missed call texts online. Article I Reserved Article II Building Board. Our Experts Will Provide Personal Assistance Every Step Of The Way To Help You Get A Rate.

Ad Highest Satisfaction for Mortgage Origination. In-house financing simply means that you borrow money from your car dealership. In house lending is a type of seller financing in which a company or broker will help a customer obtain a loan at their place of business to purchase any product or services.

In-house financing dealerships sell cars and fund auto loans all in one place. I suggest you to visit this. Ad Compare Loan Options Calculate Payments Get Quotes - All Online.

The interest rates for in-house financing are generally higher compared to banks. Typically these interest rates are fixed and given at a range between 14 to 18. This kind of financing.

Depending on your credit situation and needs in-house financing can be a great option if you. Financing directly with your car dealership. Often called buy here pay here dealerships in-house financing dealerships let.

Having a good credit standing with. So if you are in urgent. In-house financing disadvantages.

One of the quickest loan disbursal. Ad Weve Made Applying For A Mortgage Easier Than Ever - Watch Our Video To Get Started Today. Dont Wait Get Started Now.

After applying for financial assistance online the seller may approve the loan faster than ever. Ad No Credit Checks Needed. All Car Dealerships Have A Financing Department But They Facilitate Loans Rather Than.

Lock In Lower Monthly Payments When You Refinance Your Home Mortgage. In-house financing means that you borrow money directly from the dealership to finance your new vehicle. Dealerships with in-house Financing can also drive quicker and be more affordable than most loans meaning you can get on the road in the next vehicle.

In-house financing by definition is a type of home financing wherein a real estate developer allows a potential homebuyer to acquire a home on a loan. Ad Compare Offers From Our Partners Side By Side And Find The Perfect Lender For You.

In House Financing Vs Bank Financing A Future Homeowner S Guide

Loan Vs Mortgage Difference And Comparison Diffen

What Is In House Financing How Does In House Financing Work

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

/dotdash-mortgage-choice-quicken-loans-vs-your-local-bank-Final-03727f0a7b5648b296cd0970a5d52219.jpg)

How Rocket Mortgage Formerly Quicken Loans Works

In House Financing Meaning Example How Does It Work

What Is In House Financing How Does In House Financing Work

/dotdash-mortgage-rates-fixed-versus-adjustable-rate-Final-19297b62a75d4263b9865092467f306d.jpg)

Fixed Rate Vs Adjustable Rate Mortgages

/preapproved_mortgage_FINAL-22c6cd19ccd34815a10baa195848112d.png)

Mortgage Pre Approval Home Loan Checklist

What Is In House Financing Lendingtree

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/klarna_logo_bluergb.cropped-5bfc3bcb46e0fb00260f55eb.png)

:max_bytes(150000):strip_icc()/fhaloan.asp-V1-773ce9699c13471b9bf8f53e7d3824d5.png)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

:max_bytes(150000):strip_icc()/whats-difference-between-fha-and-conventional-loans_final-ede6be99eeb344c0860e12ba19c41bff.png)

/dotdash-INV-infographic-Home-Equity-Loan-v1-9ae3dc9a5cc141d5a25ed2975c08ea1c.jpg)

/14037125672_68ca580a76_k-c6247edc6c784ac2acfbb02b6077d0f9.jpg)